As a nation, we are increasingly selling off our dreams of inheriting the family house to cover nursing home care. Within this bleak landscape, I’ve honed in on a FTSE 250 stock that could stand to gain.

Nursing home costs in the UK average a hefty £4,160 monthly. Those with assets over £20,000 often have to sign Deferred Payment Agreements, staking their homes to pay for care after they’ve passed away.

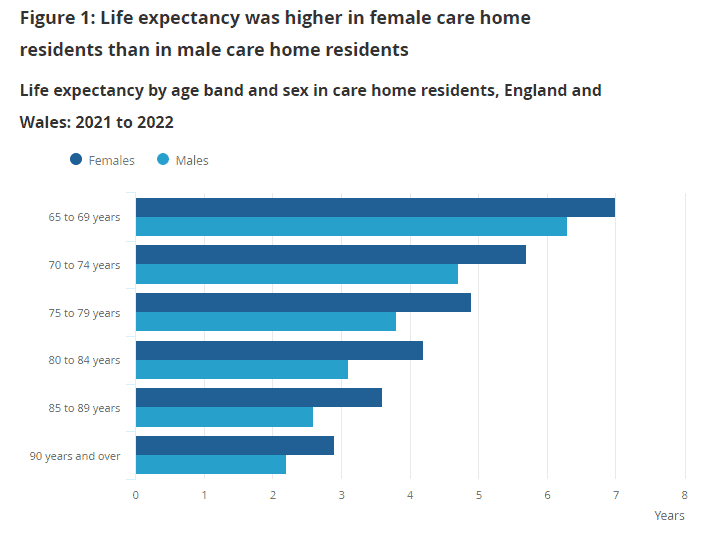

This means the asset that took a lifetime to accrue could be entirely gone after just six years in a care facility. The Office for National Statistics (ONS) suggests that this duration coincides with the average life expectancy of residents entering care from ages 65 to 74.

Should you invest £1,000 in Target Healthcare Reit Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Target Healthcare Reit Plc made the list?

Source: ONS

The opportunity

In an economy where you’re either a hammer or a nail, it pays to be the former. Enter Target Healthcare (LSE:THRL), a real estate investment trust (REIT) with a portfolio of modern care homes. This REIT boasts a 100% occupancy rate, and its homes come with a market-beating 98% wet-room coverage.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Risks and tailwinds

However, every investment carries its risks. In the case of Target Healthcare, the company’s specific risk lies in the sector’s dependence on governmental policy and funding. These factors could shift and impact profitability. In addition, its dividend cover in 2023 was 98%. That suggests it is taking on debt to fund its payouts to shareholders. On the bright side, that is a massive improvement on the 72% payout ratio reported in 2022.

With a 7.3% dividend yield and a basement-bargain share price—trading at a price to book (P/B) ratio of 0.75—Target Healthcare has got my attention.

As the stock price has fallen by 33% over the last five years, now might just be an opportune moment to invest.

Demographers expect the number of over-85s in the UK to nearly double to 3.3m over the next 25 years. To me, this looks like a company with demographic tailwinds in its sails.

As the saying goes, if you can’t beat them, join them. I’ll be adding shares in Target Healthcare when I next have spare cash.